|

|

|

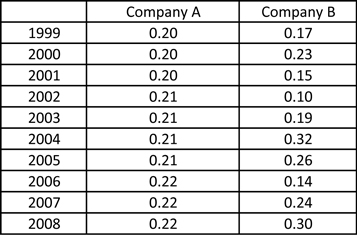

Consistent and Growing EarningsSo you've identified a dynamite company - the most lucrative investment opportunity of your lifetime? ***z-affiliate-ad-1.shtml*** Well, maybe... Outward appearances can be deceiving, so now you need to look under the hood and see if everything's running the way it's supposed to. And for a business, underneath the hood means the company's financial statements. Let's start with the income statement, or more specifically, the company's earnings... Consistent EarningsTo accurately predict your rate of return on any investment, your assumptions need to be reliable. If your most basic assumptions swing wildly in one direction or another, your expected return will be nothing more than a wild guess. So the most important factor in determining a company's value is consistency. Consistency allows you to make reasonable assumptions about the future. And if you want to make a reasonable assumption about the future value of a company, then it needs to have consistent earnings. Take a look at the following example...

Which company appeals to you most as a potential business owner? Company A, right? Why? Because of consistency. You know what to expect, and you can make plans based on the expectation of that consistency continuing well into the future. In this case, the total ten year earnings for Company A and Company B are identical. But can you see how predicting Company A's 2012 earnings is a lot easier than predicting Company B's? In fact, forget 2012... Who can predict Company B's 2009 earnings with any confidence? Much less five or ten years down the road! If you're going to estimate a company's future earnings and project its future value, consistent earnings are essential. Not only do consistent earnings provide invaluable insight into future earnings, but they're also a telltale sign of a strong and healthy business. Think about it. If a company is consistently profitable year-after-year, then it's probably profitable during both boom times and recessions. Its products and/or services probably have some sort of sustained competitive advantage which allows the company to remain consistently profitable. That's always a good sign. For instance, let's look at The Coca-Cola Company (KO). Coca-Cola is the number one most recognized brand in the world. The company's main product, Coca-Cola, has a significant advantage over generic knock-offs. Why? Because people know what they're getting with a Coke. They don't always know what they're getting with a generic brand, and they're willing to pay a few extra pennies for that comfort and familiarity. And those extra pennies add up to enormous profits. Charlie Munger, Vice-Chairman of Berkshire Hathaway, vividly illustrates this concept (the pricing power of a brand name) by using Wrigley's chewing gum as an example...

Companies with pricing power are, in most cases, extremely profitable. This is a good sign not just for profits, but for sustained profits. Force a business to compete on price and its margins will shrink until the very existence of the business as an ongoing concern comes into question. This is the typical life cycle of a commodity business (one with no identifiable competitive advantage). So avoid companies with no identifiable competitive advantage. Why? Because when you have a product that's essentially identical to your competitor's product, then your only available option is to compete on price. This eventually sparks a price war which destroys the profit margins of all the businesses involved. But branded products and services don't have to compete on price. Consumers are willing to pay a little bit more for the quality they promise. As a result, companies selling branded products and services can raise prices every once and a while without losing market share. This leads not only to a stream of strong and healthy profits, but a growing stream of corporate earnings capable of out-pacing inflation. The Need to Beat InflationIf you want your Roth IRA's investment returns to generate a comfortable sum for your retirement, it's absolutely necessary for your returns out-pace inflation. Why? Because over time, inflation eats away at the purchasing power of your savings. For example, if your Roth IRA returns 5% annually for thirty years, but inflation over the same time period is also 5%, then you haven't earned a dime on your money. You've just been marking time. Owning a slice of the earnings of a great business can help you overcome the inflation obstacle. How's that? Envision the following scenario... Inflation is 4%. Commodity prices rise along with inflation, so as a result, the raw inputs for most products are more expensive. In an effort to pass along the higher cost of producing its products, a commodity business increases the price of its product by 4%. But one of its competitors, a branded business, increases the price of its product 5% because market research reveals its customers will gladly pay a little bit more for the familiarity their product offers. That extra 1% price increase adds up to a lot, and the branded company just increased its profits and profit margin at a rate faster than inflation. Over time, this helps the business owner's earnings stay a step ahead of inflation... Growing EarningsBy now, I hope you realize the benefit of consistent earnings. But you want more than just consistency. You want increasing earnings as well. After all, the purpose of investing in a company is to grow your initial investment into a far greater sum at some point in the future, right? If you want more money in the future, either through dividends or a higher stock price, then it stands to reason that you'll need higher earnings. So a long-term trend toward higher earnings is highly desirable as well. For instance, take the following examples...

Which company appeals to you most as a potential business owner? Of course, Company A is the one everyone would want... Why wouldn't you want an increasing stream of earnings year after year? Yet, surprisingly, untold numbers of people regularly invest their hard earned money in companies with a track record of stagnant or declining earnings. Dont follow their lead. Instead, seek out companies with a history of increasing earnings. How to Find Consistent and Growing EarningsSo how do you find out if a company has a strong track record of consistent and growing earnings? The best way is to go to your local library and find the Value Line Investment Survey. My local library has the latest releases from the Value Line Investment Survey in several three-ring binders. The first few pages of the first binder provide an alphabetical listing of the 1,700 largest publicly traded companies in the United States. Use this table of contents to find the page number for your company's listing. When you find your company's page, it will have a listing of corporate earnings for the past ten years. These figures are more accurate than those you might run across on the Internet, and they're easily laid out so you can tell at glance whether or not the company's earnings are consistent and steadily increasing. Consistent and Growing EarningsObviously, as the owner of a company, you want earnings to be consistent year-to-year and to exhibit an increasing upward trend. You wouldn't want the paycheck from your job to markedly increase or decrease month-to-month, would you? Would you want your paycheck to slowly decrease year-by-year, so you could look forward to less money in the future? Of course not! So why buy into a company whose earnings offer you the same? Now that you've found a company with consistent and increasing corporate earnings, it's time to check its return on equity (ROE) to see if it measures up to your high standards... Learn About Factor #2 - High Return on Equity >>> ***z-affiliate-ad-2.shtml*** Return to the top of Consistent and Growing Earnings Return to Trading Stocks In A Roth IRA Return to the Your Roth IRA Website Homepage

|

What's New?Read 5 Reasons Why I Love My Roth IRA, our part in the Good Financial Cents Roth IRA Movement! Start planning ahead for next year by checking out 2017 Roth IRA contribution limits, and stay alert to this year's changes to the 2016 Roth IRA contribution limits. Our family fully funds our Roth IRA with this website. Learn how you can do it too. Are you confused or frustrated by the stock market? Learn how to build real wealth selecting individual stocks for your Roth IRA... Read more about what's new on the Roth IRA blog. Hi, I'm Britt, and this is my wife, Jen. Welcome to our Roth IRA information website! This is our humble attempt to turn a passion for personal finance into the Web's #1 resource for Roth IRA information. But, believe it or not, this site is more than just a hobby. It's a real business that provides a stable and steady stream of income for our family. In fact, because of this site, Jen is able to be a full-time stay-at-home mom and spend more time with our daughter, Samantha. But you want to know the best part? ...You can do the same thing! Anyone with a hobby or a passion (even with no previous experience building a website) can create a profitable site that generates extra income. If you're tired of solely depending on your job(s) for family income, click here now and learn why our income is increasing despite the financial crisis and how we're making our dreams come true. |

|

Search This SiteRoth IRA BasicsMore About Roth IRAsRoth IRA ResourcesAbout Your Roth IRALike Us On FacebookFollow Us On Twitter

RSSDisclaimerThe information contained in Your Roth IRA is for general information purposes only and does not constitute professional financial advice. Please contact an independent financial professional when seeking advice regarding your specific financial situation. For more information, please consult our full Disclaimer Policy as well as our Privacy Policy. Thank YouOur family started this site as a labor of love in February 2009, a few months after our daughter was born. Thank you for helping it become one of the most visited Roth IRA information sites. Thank you, too, to the "SBI!" software that made it all possible. We hope you find what you're looking for and wish you much continued success in your retirement planning! |

||

|

| ||